Discover Corporate Sustainable Value for A better Future

Sustainable Finance - Published Projects

Background

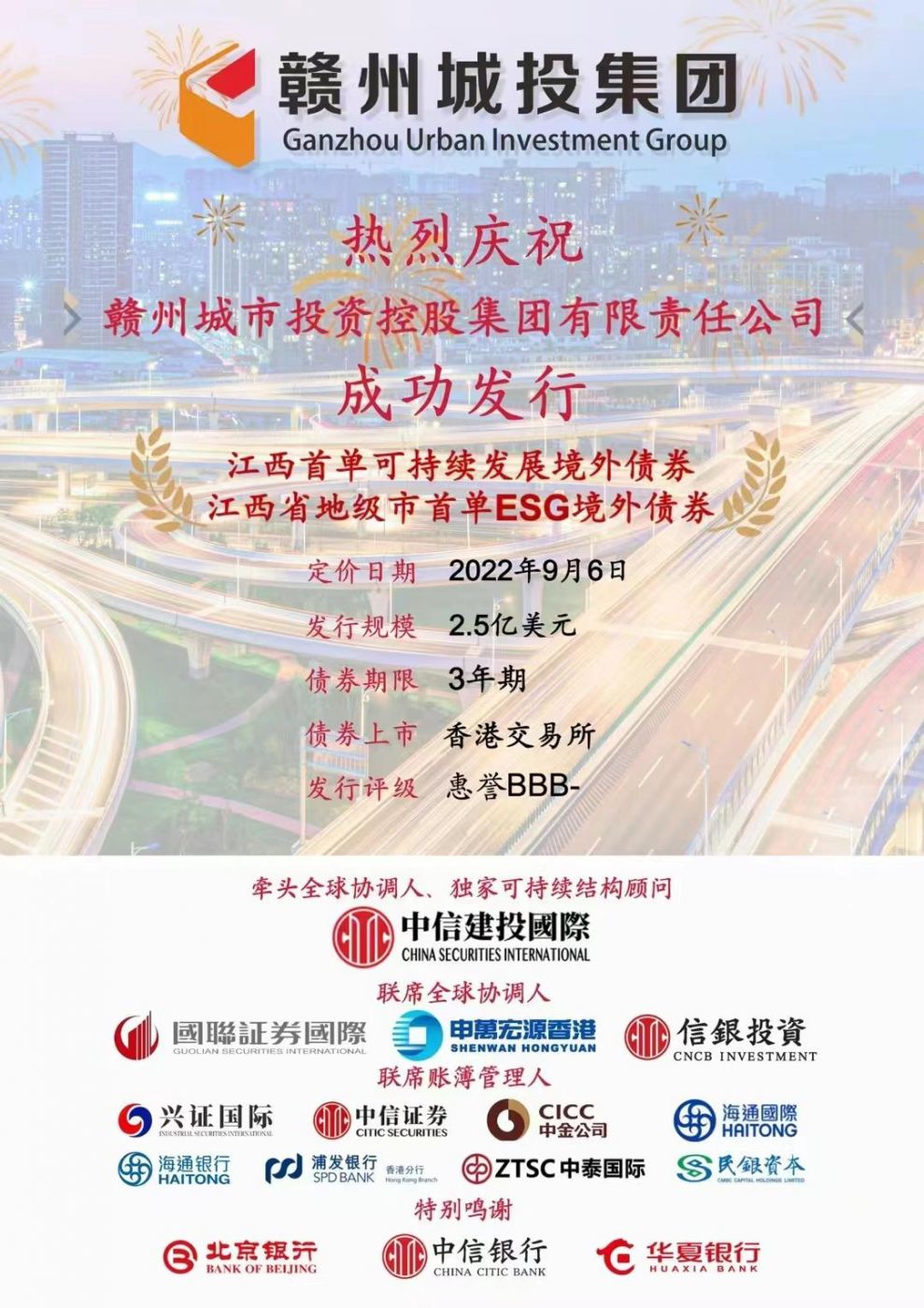

CECEP Environmental Consulting Group Limited (“CECEPEC”) recently issued a Second Party Opinion (“SPO”) on the Sustainable Finance Framework (the “Framework”) of Ganzhou Urban Investment Holding Group Co., Ltd. (“Ganzhou Urban Investment Group” or the “Group”).

CECEPEC considers the Framework is in line with the four core components of Green Bond Principles 2021 (“GBP”) and Social Bond Principles 2021 (“SBP”) issued by International Capital Market Association (“ICMA”) and Green Loan Principles 2021 (“GLP”) and Social Loan Principles 2021 (“SLP”) published by the Loan Market Association (“LMA”), the Asia Pacific Loan Market Association (“APLMA”) and the Loan Syndications and Trading Association (“LSTA”). Under the Framework, the net proceeds will be used exclusively to finance and/or refinance Eligible Projects, in whole or in part. The Eligible Projects include Eligible Green Projects and Eligible Social Projects. The Eligible Green Project Categories encompass sustainable water and wastewater management, renewable energy, energy efficiency, and environmentally management of living natural resources and land use. The Eligible Social Projects can fall into affordable housing and access to essential services categories. The Eligible Projects intend to contribute to the United Nations Sustainable Development Goals (“UN SDGs”) and Targets.

The Framework states the process for project evaluation and selection and management of proceeds. Ganzhou Urban Investment Group has implemented a series of measures to identify, evaluate, and mitigate related environmental and social risks. The Group also adopted International Finance Corporation Exclusion List (2007). Ganzhou Urban Investment Group will prepare the Allocation Reports annually via the Group official website, social media, or report. The Group states that it will prepare the Impact Reports with the potential indicators listed in the Framework to quantify the environmental and/or social benefits of the Eligible Projects where possible and subject to data availability.