【To give priority to green bonds】External review of green bonds to improve the recognition of international capital market

Foreword

Climate change is a global issue for mankind. During the 2021 Two Sessions, with carbon-to-energy and carbon-to-energy being included in the government work report for the first time, China has proposed carbon-to-energy and carbon-to-energy targets, and will actively plan for carbon-to-energy in 2060 through various measures. Mr. Ma Jun, Chairman of the China Green Finance Committee, pointed out that carbon neutralisation requires millions of dollars of green and low-carbon investment, most of which need to be realized by mobilizing social capital through the financial system. Regarding the scale of green and low-carbon investment required for carbon neutralization, many experts and institutions have different estimates. For example, the “Research on China’s Long-term Low-carbon Development Strategy and Transformation Path” report proposed four scenarios, of which the target-oriented transformation path of 1.5 ℃ is achieved, requiring an accumulated additional investment of approximately RMB 138 trillion, exceeding 2.5% of the annual GDP. As China will increase its investment in green industries in the long run, the green transformation of China’s economy requires substantial capital support. As a relatively long-term and stable source of financing, green bonds will effectively help green industry projects reduce the risk of maturity mismatch. As an international financial centre, Hong Kong is committed to promoting the development of green finance and formulating relevant policies and plans for green and sustainable finance. In May this year, the Hong Kong Monetary Authority (HONG KONG MONETARY AUTHORITY) announced the guideline of “Green and Sustainable Financial Assistance Programme” to provide funding for eligible bond issues and loans to facilitate green and sustainable bond issues and lending activities.

In response to the situation, through green investment and financing, enterprises will be able to ensure that they are in line with the law of social development and the policy orientation, and to witness the development of the next century together with the state.

Green and Sustainable Financing

Green bonds are a financing instrument which gives a new definition on the basis of traditional bonds. Green bonds raise funds from investors through the capital market, providing financing needs for projects that can bring positive effects on environment, economy and climate benefits. Based on the climate targets set in the Paris Agreement signed in 2015, climate experts expect to require US $90 trillion in green investment within 15 years to contribute to this goal. Therefore, green and sustainable bonds, as an important way for green investment, are widely recognized as an innovative and win-win financial solution that can create value for issuers, investors and the entire human society. With the increasingly prominent ecological problems of the earth and the lingering COVID-19 pandemic around the world since 2020, the international community has been inspiring to constantly reflect the relationship between human and nature. Against this backdrop, the global sustainable debt market size reached a record high in 2020, during which the global market issued more than US $700 billion of green and sustainable related debts, doubling the previous year.

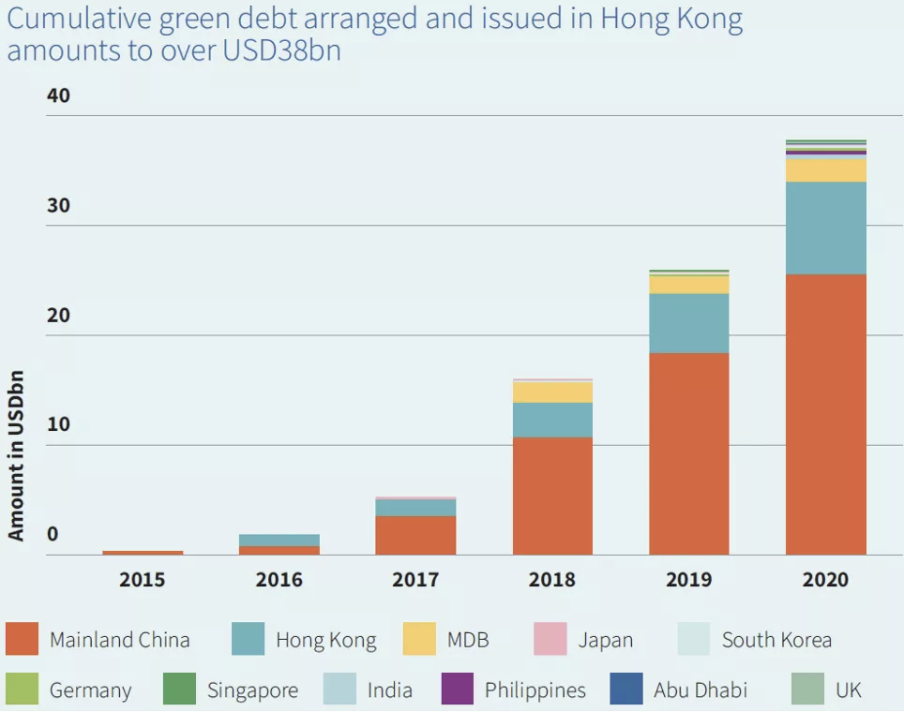

With strong policy support, internationalization and maturity of the financial market, Hong Kong maintained its position as the preferred region for Chinese enterprises to raise green debts overseas. Hong Kong’s green debt market is flourishing, with significant growth in scale and diversity. During 2020, Hong Kong’s green debt issuance exceeded US $12 billion, of which green loans amounted to US $1.3 billion. As shown in the chart below, by the end of 2020, Hong Kong has issued more than US $38 billion of relevant green debts.

Figure 1: Green debt issuance in Hong Kong by region in recent years

To meet the relevant standards of green bonds, an independent third party is required to conduct an external review. In the past two years, according to the statistics of the Climate Bond Initiative, all enterprises have passed the external review for the issuance of green bonds in Hong Kong. According to research and analysis, all different forms of external assessments have significant impacts on the enterprise, therefore, the enterprise can usually benefit from the bond issuance process through the participation of external assessment institutions.

External Appraisal Value

From the issuer’s perspective, the advantages of green bonds under external review are usually reflected in the following aspects:

01: Green bonds with external review are more cost-effective

According to the 2020 research report of the Hong Kong Monetary and Financial Research Centre (HKIMR), based on the green bond data of major international databases as of June 2019, after careful screening and comparative analysis, the green bond issuance has certain cost advantages as compared to traditional bonds with same or similar characteristics (such as bond size, maturity, liquidity and credit rating) of various types of bonds. After analysis of 267 green bond samples, the average negative premium of green bonds is-1.2bps. Such insignificant advantages cannot substantially affect the decision of the issuer. However, the negative premium is relatively large in the green bond issuance of different issuers. When the average premium of most green bond issuance is close to zero, some negative premium of green bond issuance has reached the scale of-50bps, which has a substantial improvement on the cost of the issuer.

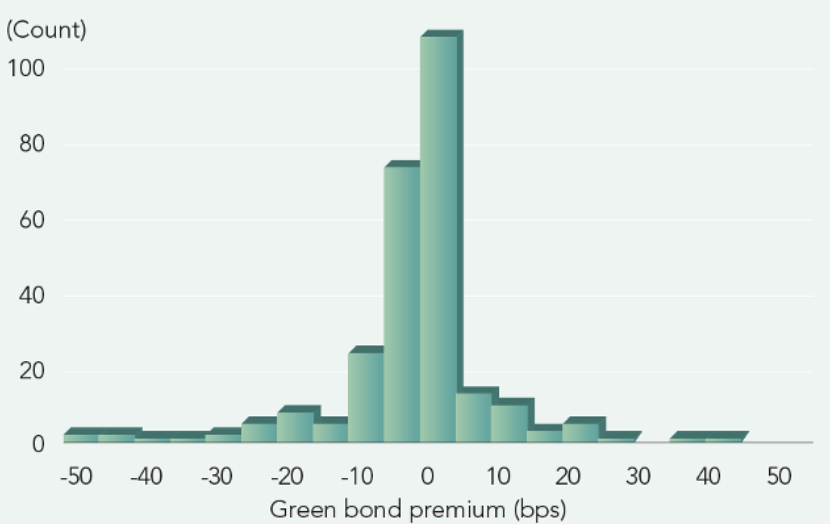

Figure 2: Distribution of Green Bonds Premium

(Each column shows the number of green bonds within each premium range)

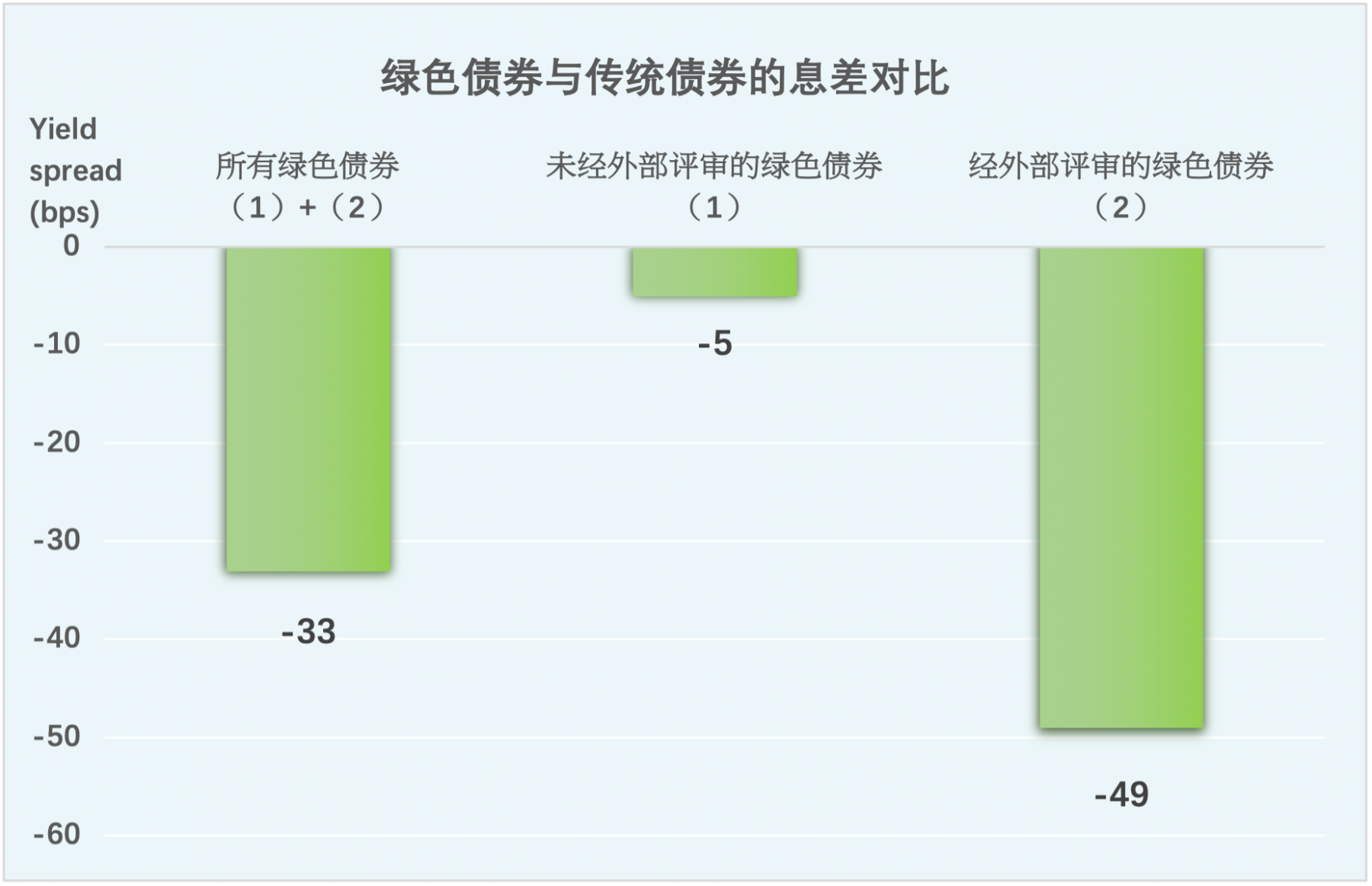

In addition, after an external review of green bonds, the yield-to-maturity of such green bonds has a significant negative spread performance compared to traditional bonds. Another study conducted by HKIMR for issuers in the United States, Mainland China and Hong Kong indicated that since 2013, issuers that have issued at least one green bond have compared the spread of such green bonds with comparable traditional bonds (issued by issuers that do not issue green bonds) in the same period. As can be seen from the chart below, the issuance of green bonds can reduce the issuance cost by an average of 33bps compared to traditional bonds. In particular, green bonds subject to external review can reduce the issuance cost by nearly 50bps as compared to traditional bonds, while green bonds without external review can only reduce the issuance cost by approximately 5bps. This phenomenon also indicates that green financing projects with higher credibility and higher value to investors after external review.

Figure 3: Comparison of spread between green bonds and traditional bonds

It can be seen that external review of a company’s own green bonds is crucial for investors. On the one hand, green bonds with external review theoretically have the opportunity to enjoy the advantage of lower financing costs; On the other hand, external review of green bonds can not only enhance the credibility of bonds, but also be used by investors to support their green investment strategies. The current supply of green bonds that have been reviewed externally in the investment market is short of demand, making it easier for investors and provide a positive impact on enhancing the pricing power of bonds.

02: Green bond issuance helps improve internal green and sustainable governance

As the policy environment of the capital market becomes more stringent, mandatory information disclosure will be the future trend. The international green financial principles, information disclosure standards and external review process required for the issuance of green bonds by enterprises are good practice opportunities for enterprises to establish an internal green and sustainable financial management and governance system and to conduct compliance disclosure, so as to make sufficient preparation for the broader mandatory ESG information disclosure and regulatory requirements in the future.

03: Enterprises can benefit from preferential policies

Benefiting from the recent Hong Kong Monetary Authority’s subsidy scheme for green and sustainable bonds, the overseas green and sustainable bonds issuance in Hong Kong will maintain a steady growth trend, and eligible bonds and loans issuance as well as external assessments will receive government subsidies, which will commence on 10 May 2021 for a term of 3 years. As one of the first batch of “Green and Sustainable Financial Assistance Plan”, CECEPAC recognized that external assessment institutions can provide relevant external assessment services for enterprises, click on the original link at the end of page or directly contact us to understand more relevant contents.

For the capital market, green bonds are an excellent investment target

Green bonds have the characteristics of high return and low risk, and are excellent investment targets.

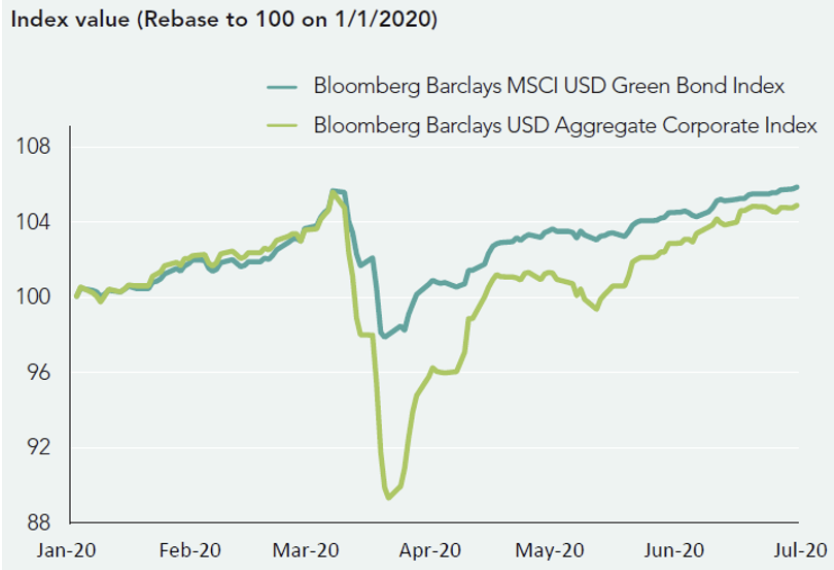

Green bonds are an important subject of ESG investment in the capital market, and its advantages make various emerging sustainable investment funds highly competitive. According to the analysis by Morningstar (Morningstar), aninternational authoritative rating agency, of 745 European sustainable investment fund samples over the last 10-year period, green bonds have a higher rate of return than traditional investment funds, with more stable yield volatility over the period. Meanwhile, in terms of risk resilience, the performance of green bonds was particularly outstanding. Since the COVID-19 pandemic swept across the world since 2020, the global financial market has experienced significant volatility, and green bonds have demonstrated their excellent risk resistance characteristics. The chart below shows the comparison of the two indexes at the beginning of the pandemic, and the index led by green bonds has a smaller fluctuation and a better trend.

Figure 4: Green Bond Index showing excellent risk resilience during the COVID-19 pandemic

BlackRock (BlackRock) selected 32 global representative sustainable index samples and their corresponding traditional index samples, and analyzed the trends of various indices during the period of financial market downturn in 2015-2016, 2018 and the first quarter of 2020, respectively. The data showed that the performance of the period’s sustainable index was better than that of the traditional index. Given that the pandemic is still spreading around the world, with global political games and economic uncertainties, risk control is the top priority of investment. It can be seen that green bonds can be regarded as an excellent investment target in the capital market, and under this background, if an enterprise issues green bonds that have passed external review, it will be more favored in the overseas capital market.

CONCLUSION

It is difficult to discover that by conducting external review for the issuance of green bonds and obtaining the second opinion or verification report from a professional valuation institution, it can support the enterprise to expand its financing cost advantage, gain high market recognition and create long-term value for the enterprise. Currently, the Hong Kong Monetary Authority provides external assessment subsidies for qualified green bond issuance and green loans. CECEPAC is recognised as one of the first batch of external assessment institutions under the “Green and Sustainable Financial Assistance Programme” in Hong Kong. CECEPAC continues to provide external assessment services for green and sustainable bond/loan issuance of major enterprises. So far, CECEPAC has assisted a number of large enterprises to issue green bonds overseas independently. If the Company is interested in our services or this content, please contact us directly.

Source of reference:

1. Hong Kong Green Finance Association (2021). Ma Jun: Improving the green financial system with carbon neutral as the goal.

https://www.hkgreenfinance.org/ma-jun-carbon-neutrality-as-goal-to-refine-green-finance-system/? lang=zh-hant

2. Hong Kong Monetary Authority. (2020). “Green and Sustainable Financial Assistance Programme” Guideline.

https://www.Hong Kong Monetary Authority.gov.hk/media/gb_chi/doc/key-information/press-release/2021/20210504c4a1.pdf

3. BlackRock. (2020). Resilience amid uncertainty.

https://www.blackrock.com/corporate/literature/investor-education/sustainable-investing-resilience.pdf

4. CBI. (2020). China Green Bond Issuance and Opportunity Report

https://www.climatebonds.net/node/54716

5. CBI. (2021). Hong Kong Green Bond Market Briefing 2020.

https://www.climatebonds.net/resources/reports/hong-kong-green-bond-market-briefing-2020

6. HKIMR. (2020). The Green Bond Market in Hong Kong: Developing a Robust Ecosystem for Sustainable Growth

https://www.aof.org.hk/docs/default-source/hkimr/applied-research-report/gbrep.pdf

7. Lau, P., Sze, A., Wan, W. & Wong, A. (2020). The economics of the greenium: How much is the world willing to pay to save the Earth? HKIMR Working Paper No. 09/2020.

https://www.aof.org.hk/docs/default-source/hkimr/working-papers/full-textd9d34bad03564298ae871c751e5fbff3.pdf? sfvrsn=c68509c6_0

- Subscribe Us On WeChat -

Official accounts:中節能皓信CECEPEC

中國節能皓信環境顧問集團

CECEP ENVIRONMENTAL CONSULTING GROUP

Sustainability | Environment & Climate Change| Sustainable Finance

Green Building | EnvAI 2.0 | Professional Training

* The information contained herein is for general reference only and there can be no assurance that such information will be accurate at the time of your receipt or in the future due to factors such as policy updates and market changes. The Group does not accept any responsibility for any action taken without due consideration of the circumstances and to obtain appropriate professional advice based on the information contained in this publication. If a third party agency wishes to reproduce the article, the original reproduction must not be modified and the source of the article must be indicated. Prior written consent from CECEPEC is required for any changes to the contents of the articles.